There are a lot of different ecommerce payment options to choose from when setting up your online store. This guide will help you choose the right ones for you and your customers.

We’ll cover:

- The definition of payment gateways

- The things you need to consider when selecting an ecommerce payment platform

- 12 payment platforms for you to consider

The benefits of payment gateways in ecommerce

Payment gateway technology is used by store owners to accept credit and debit cards from shoppers. In a traditional sense, the term refers to both physical, card-reading devices found in stores and payment processor apps, typically found on ecommerce websites. However, in this post, we’ll only talk about the latter. So any time we mention a payment gateway, we’re talking about an online application.

Why do small businesses need payment gateways?

- They make the checkout process easier

- They keep customers’ information safe

1) They make the checkout process easier

Have you ever tried to buy an item only to find out that the purchase process is overly complicated and not worth your time? There’s a good chance you did. Most shoppers come across this problem more often than you think.

That’s why shopping cart abandonment rates are still considerably high. This March, more than 88% of shoppers in the United States have filled their virtual shopping carts, only to abandon them completely, before finishing the transaction.

If you want to decrease your cart abandonment rates, allow your customer to make purchases easily, and improve your revenue, you need a good payment gateway. It will remove any possible barriers, make the process feel intuitive, and lessen the need for customer support..

2) They keep customers’ information safe

Every day, thousands of people have their credit card numbers leaked, identities stolen, their bank accounts drained. For that reason, most shoppers are mainly concerned about preventing ID theft.

Recent studies indicate that around 1 in 5 online shoppers have had their identity stolen at some point in their life. Because of this, around 40% of consumers will only buy products from well-known websites.

If you want to attract new customers, you need to make them feel safe.

The best way to do that is to use a payment service that will keep their sensitive information completely safe. Your system needs to have proper encryption along with other security features. Being transparent about your security measures can also help.

What to consider before selecting a payment gateway

There are dozens if not hundreds of payment platforms for you to choose from. If you’re opening an online store for the first time, you’re probably not sure what to look for. We want to explore the common options you have to you.

When selecting a payment gateway for your ecommerce business, there are three specific things you should keep your eye on.

On-site and off-site processing

The first thing you need to think about is whether you want your shoppers to leave your website or not.

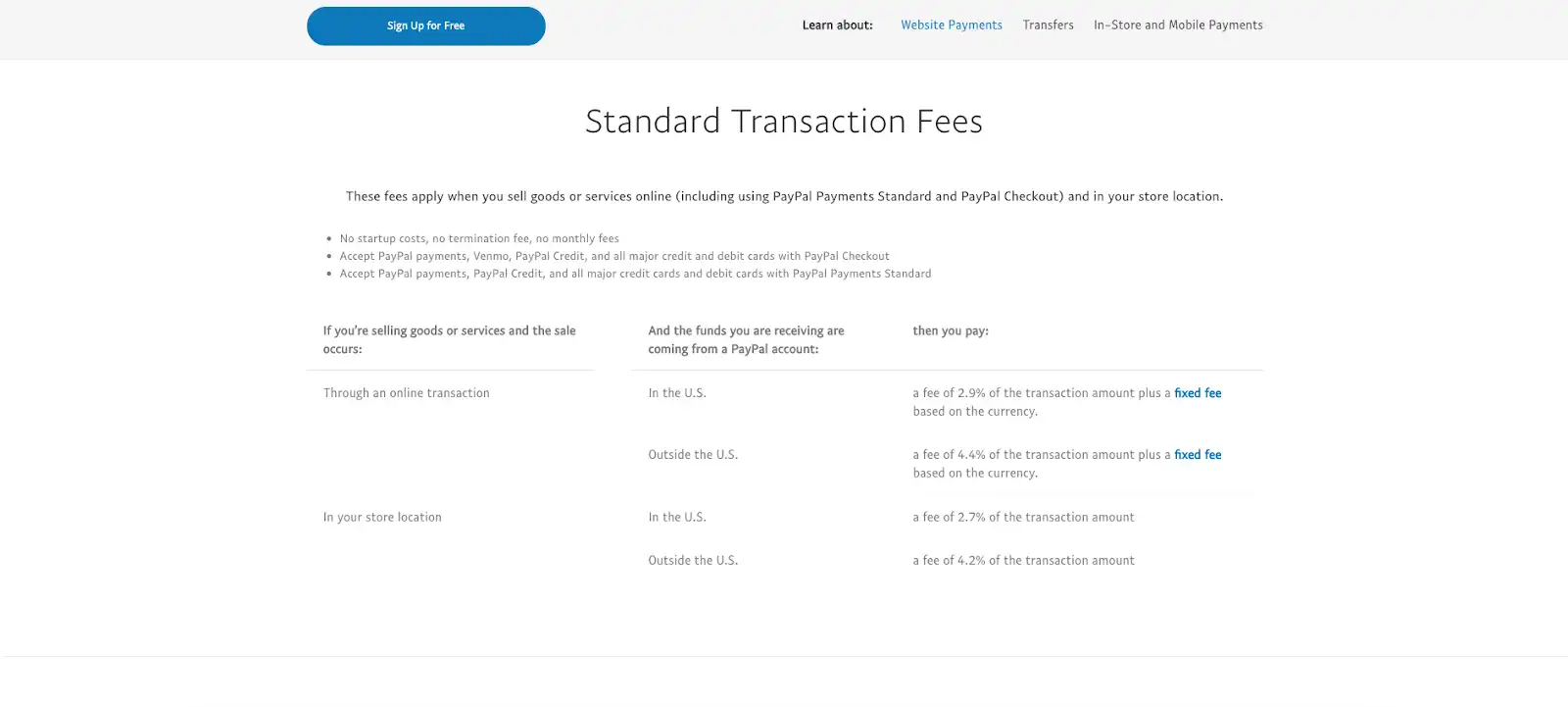

For example, PayPal, one of the biggest payment solutions out there, requires users to leave the merchant’s website in order to finish their payment process. You can pay a fee to make sure the payment is processed without requiring shoppers to go to an external site. We highly recommend choosing a payment option that will keep uses on your site.

Types of payment methods

Different companies have different payment methods. Besides debit and credit card processing, there are plenty of other options including gift cards, financing, cryptocurrencies, and many more 3rd-party options.

In order to know what will work best for you, getting familiar with your consumer base is a must. See what payment methods your visitors prefer and only then make a choice.

Customer protection and security

We simply can’t stress enough the importance of data protection. If the payment platform you’ve started using has experienced data leaks, then the consumers might not be too keen on doing work with you.

Moreover, you should make sure that the platform you’re using doesn’t come with any hidden monthly fees. The safety of your consumers should be your number one priority.

{{lead-magnet-1}}

12 ecommerce payment options

To help you prevent high cart abandonment rates, we’ve narrowed down the best ecommerce payment options for 2023.

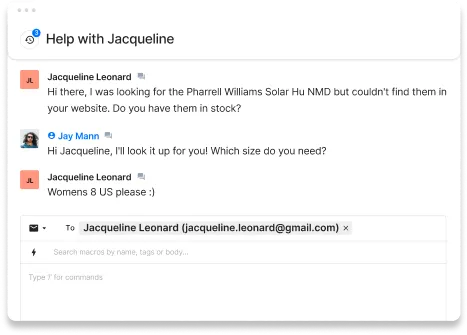

1. PayPal

Image Source: PayPal.

PayPal needs no introduction. It’s the biggest payment processing platform on the globe, with more than 254 million active users. What’s more, ecommerce stores using PayPal have 82% higher conversion rates than their competitors.

However, like everything else, PayPal isn’t perfect. Unlike some of the platforms we have on the list, it isn’t free. PayPal has pretty high fees that will vary from region to region. Of course, with enough volume this can be negotiated.

PayPal is also known for holding payments for up to six months. They aren’t exactly the sellers’ first choice, but with such a high market share, customers trust them which is why we’re ranking them number 1 on our list of payment providers.

2. Shopify Payments

Image Source: Shopify.

Second on our list is the payment gateway developed by Shopify. Since it’s the most widely used ecommerce platform in the world, it only makes sense that the company would create its own payment system.

Similar to WooCommerce Payment below, you can access Shopify Payments from your dashboard. Shopify Payments keeps your customers on your site, and is included with your plan.

As Shopify continues to evolve, they’ve also rolled out Shop Pay. It’ll allow customers to store their billing and shipping details, and in turn, make the checkout process a lot quicker.

3. Magento Payments

Magento has been around for more than a decade at this point. Based on their experience with online merchants, the company has launched Magento Payments, a platform that can help you reduce operational complexities, lessen costs, and improve conversions.

Furthermore, with a merchant account, Magento Payments gives you an all-in-one solution that streamlines the payment process for you and your customers. It eliminates the need for 3rd-party account management, additional expertise, or subscription costs.

4. Big Commerce

With cost-effective price plans and customizable options, this SaaS platform works perfectly for small ecommerce stores and mid-sized business owners. It offers more than 55 pre-integrated payment gateways to ecommerce sellers from all over the world.

At the moment, the payment option is available in almost 100 countries. It’s also available in more than 140 world currencies. The setup is also perfect for beginners: you just need to click a single button, and you start accepting credit card payments from all of the major players.

5. Visa Checkout

Image Source: CloudApp.

If many of your shoppers are Visa holders, Visa checkout should be the most obvious payment solution for you. Considering the fact that there are more than 21 million Visa Checkout users across the globe, it’s a safe bet that some of your visitors might prefer this payment option.

With this option, Visa users won’t have to fill in their personal information. They’ll be able to enter their credit card information, and they’ll be able to finalize the purchase. Visa Checkout can potentially increase conversions by 42%. A little convenience can go a long way.

6. Square

Most users associate Square with POS payments, however, the company offers ecommerce payment processing services as well. By using their API, your website will be able to accept a number of payment methods from this list, including Google Pay and Apple Pay.

And that’s not all. Square can also make things easier for your customers additionally, by allowing them to create their own profiles. That means, they won’t need to input their login data every time they want to purchase something from you.

If you’re already using Square POS, adding them to your website may be a natural fit.

7. Stripe

Image Source: Stripe.

Besides on-demand marketplaces and crowdfunding campaigns, Stripe works perfectly for people that have their own stores as well. More than 1,000 of ecommerce stores have managed to build their business around Stripe.

According to research commissioned by Stripe, companies using the platform have been able to increase their revenue by 6.7% during the first year of business. Compared to others, Stripe users also have 24% lower operating costs.

Stripe is so trusted, that Shopify Payments is built on it.

8. ProMerchant

This Massachusetts-based company offers a number of processing solutions to its customers. One of their most popular products is an ecommerce payment platform that's free to use. There are no upfront costs when you’re accepting card payments.

The company uses Authorize.net as their payment gateway platform. This allows you to be as flexible as possible. With ProMerchant, your store will be able to accept payments from a number of different companies, including Mastercard, Visa, and Discover.

9. Amazon Pay

Millions of people use Amazon to buy products every single day. There’s no reason not to try and turn some of these people into regular customers? By using the Amazon Pay platform, you’ll allow Amazon users to shop on your website without jumping through hoops.

For many people, the registration process takes too much time. They don’t want to enter their information, come up with a password, and wait for a confirmation email just to buy something. Remove all of these barriers with Amazon Pay.

10. Apple Pay

Nearly two-thirds of Americans use Apple products. For most of them, their Apple product doubles as a digital wallet. Naturally, they use their Apple accounts to pay for products on websites that accept it.

Apple Pay makes things incredibly easy for iPhone owners by leveraging touch identification and allowing users to pay for products with literally a single touch. If you want to get a piece of the action, then consider this platform.

Apple Pay, like Google Pay, makes mobile checkout almost instantaneous, and is already included with many payment providers.

11. Google Pay

Millions and millions of people already have their data saved on Google accounts. That’s why the biggest tech giant in the world has created its own payment platform. If you’re targeting a large user-base, it can’t get larger than this.

Additionally, Google offers top-notch security that will make the consumers feel safe at all times. The platform can help you set up a loyalty program, offer gift cards, and various other discounts for most-loyal buyers.

12. WooCommerce Payment

Let’s round it off with a built in integration. If you’re a WooCommerce user with no intention of changing your platform, then this could be the right solution for you. WooCommerce payment allows you to manage your finances swiftly and safely.

You don’t have to learn anything new, either. You can safely use the plugin from the safety of your dashboard.

Improve the customer experience

Now that you’re familiar with the best ecommerce gateways, you can improve the experience of your customers, help them finish their purchase in a matter of seconds, and grow your store, without managing cart abandonment rates all the time.

So let’s recap:

- Payment gateways are there to make the purchase process easier

- Without the right payment platform, your shoppers will feel insecure

- Select a platform based on your needs

{{lead-magnet-2}}