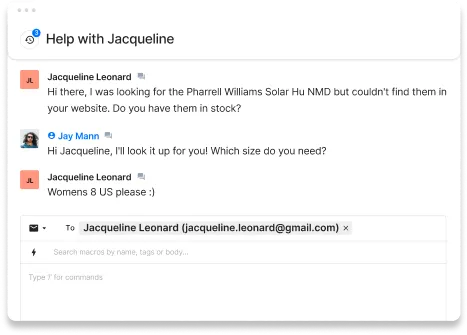

As many of you already know, Gorgias has spilled their blood, sweat, and tears into creating the best customer support platform on the market.

BUT...

We want to provide our customers with more.

More value. More possibilities. And, most importantly, more opportunities to grow and scale your online business.

...Enter our new show Vested Interest.

Like Shark Tank and Dragons Den, Gorgias is partnering with venture capital companies, including Greycroft, Swiftarc, and Rosecliff. You guessed it...successful applicants have the chance to pitch investors and receive valued feedback and advice. Pitching helps brands boost their profile, and may even lead to a second conversation with an investor.

So, in honor of our exciting new initiative, in this blog post, we're delving into ecommerce fundraising in more detail. More specifically, what it is, why you should consider it, and how to raise those all-important funds to transform your business dream into reality.

Does that sound good to you? Fab! Continue reading to find out more...

What's Business Fundraising?

First things first, we want to clarify what ecommerce fundraising actually is. In short, it's the process online merchants take to secure the funds they need to launch and/or grow their ecommerce businesses.

Traditionally, business fundraising was associated with start-ups, brick and mortar stores, and scaling companies to reach new heights.

But, fast forward to today, more and more DTC brand owners and online merchants are also leveraging capital to launch and/or expand their business.

And there's no reason you can't do the same.

Of course, there are several ways to raise business capital, but some of the more popular routes include:

- Venture capital

- Crowdfunding

- Angel investors

- Taking out a bank loan

- Equity investors

- Revenue-based financing

As we've just said, there are plenty of other fundraising avenues, but for the purposes of this article, we're focusing on these.

What are the Different Business Fundraising Options?

Let's explore the options above in a little more detail...

Angel Investors

Seeking funds from an angel investor(s) might be the ideal option if you're running a small ecommerce brand that's generating steady profits. I.e., without external funding, you're doing okay. Still, to take your business to the next level, you need a cash injection.

This is where an “angel” investor might come in handy.

Typically speaking, angel investors are wealthy people, or groups, who pool their know-how, research, and resources to provide promising start-ups capital.

Generally, angel investors give companies some sort of financial assistance in exchange for either convertible debt (i.e., the promise of converting part (or all) of the loan into common shares, at some point in the future) or ownership equity.

Usually, you'll approach an angel investor with a pitch outlining who your business is, how much money you want to secure, and what you hope to achieve with their finances.

As the size of angel investments substantially varies (usually anywhere under $50,000 to over $500,000), you'll have to prove how you'll provide reliable results. You need to show investors why your business is worth their time, and more importantly, money. After all, it stands to reason, if you can prove your brand will go the distance, the safer bet you are for them to invest in.

Then, after your initial meeting(s) with the angel investor(s), they'll typically go away and conduct their own research, ask you questions, etc. to help determine whether your proposition is a good fit with their investment portfolio.

Crowdfunding

In short, crowdfunding is where a wider pool of small-time investors assist a company during its earlier stages. As crowdfunding is typically used to accumulate funds to launch, these businesses often have a minimal (if any) track record of their profits. As such, this fundraising method is ideal for those with a killer business idea, without the financial forecasts to wow angel investors, banks, or venture capital firms.

There are tons of crowdfunding sites online. For instance:

These are just a few of the many online crowdfunding platforms on the web. But, the ones above are a great starting point - here, you can get your brand and business plan in front of loads of people actively looking to invest in fledgling businesses.

How to Run a Successful Crowdfunding Campaign

Crowdfunding relies on your ability to inspire trust and enthusiasm in your audience. Show them you've done your research and are prepared to put their money to good use. This means breaking up your estimated costs and demonstrating where the money will go. For instance, how much is allocated to production, how much on design? Showing you understand your costs improves your credibility.

Whatever crowdfunding platform you choose to use, post regular updates, and answer questions. Show the community that's building around your idea that you care for their involvement. Investing in a crowdfunding project can be daunting, some investors might fear that you won’t come through. So, demonstrate from the start that you're reliable and fully invested in putting their worries at bay.

Last but not least, make sure your crowdfunding campaign is well presented. Where possible, use high-quality graphics and video content. Proofread your proposal, ensuring all the info is shown in a way that's logical and easy-to-read. Get friends and family to check over your campaign description for you. Professionalism goes a long way in inspiring the confidence of potential investors!

Venture Capital Investors

Securing investment from venture capital firms like Greycroft, Swiftarc, and Rosecliff, is (usually) better suited to larger online enterprises. For the uninitiated, 'venture capital' is a form of private equity and financing that investors provide businesses with long-term growth potential.

Entrepreneurs typically secure this kind of financing from affluent investors or investment banks. But, it's worth noting that venture capital doesn't always take a monetary form. Venture capital can also be provided as technical or managerial expertise.

As investments go, plowing money into an ecommerce business is one of the riskier options. But, the potential for above-average returns is enticing, so we're seeing more and more investors adding online brands to their investment portfolio.

However, the main drawback for brand owners is that investors usually get equity in the company. As such, you'll give up the luxury of having full control over your business's operation. You don't need us to tell you that this a big deal. So, take your time weighing up the pros and cons of any investment agreement before signing the dotted line!

Equity Investors

Equity investors do precisely what they say on the tin. They're people who provide companies with financial investment in exchange for a share of the business's ownership.

Generally, equity investors don't get a guaranteed return on their investment. But, should the company be liquidated, the equity investor will get a share of the assets (as stipulated in your contract).

Unsurprisingly, as equity investment is a riskier option for investors, they often expect to receive certain benefits to offset these risks. For instance, your investment agreement might stipulate that their initial investment is paid back within a specific time frame. Then, afterward, it's common for investors to be paid a pre-agreed share of the profits once you've paid back their initial investment.

Alternatively, (or as well as) equity investors can receive stock shares. Of course, stocks rise and fall depending on the market. So, again their return on investment isn't set in stone. But, the investor has the luxury of selling their stocks on the stock market or via other trading platforms, whenever they feel like it. So, be sure to bear that in mind while you're drafting up your agreement.

Securing a Business Loan From a Bank

Of course, the more traditional route for securing funding is to apply for a small business loan with a bank or other reputable lending institution.

If this is an avenue you're considering, you'll want to know why business loans get rejected to increase the likelihood of securing your requested funds.

Interestingly, the most common reason cited for why business loans are rejected is 'risk.' This is why thoroughly preparing before meeting to discuss (or applying) for a potential loan is imperative. You want to do your utmost to show you’re ‘low risk.’

Part of this planning phase will be gathering the below details and documents:

- Your personal credit history

- Your business plan

- The workability of the business you're launching/expanding

- Your experience

- Your education

As you go about creating your business plan, focus on explaining why the small business loan you're asking for is a low-risk proposition. Be sure to carefully assess how much money you need and why. Outline how you'll spend these funds, and how the loan will specifically help you launch and/or grow your business.

Be prepared to explain how you'll designate every dollar you've asked for, with specific reference to your business's following aspects:

- Business operations (employees, software, marketing, utilities, etc.)

- Physical assets (equipment, office space, warehousing, etc.)

- Consolidating loans to pay off business debts.

You'll also need to explain how you'll repay the loan through your financial statements and cash flow projections. This should highlight to the potential lender that you're able to repay them over a set amount of time.

Revenue-Based Financing

Revenue-based financing is sometimes referred to as royalty-based financing, so don't let the interchangeable terminology confuse you. Both terms mean exactly the same thing!

In short, revenue-based financing is a method businesses use to raise capital from investors. In turn, the investors receive a percentage of the company's regular gross revenue until a pre-set amount is paid (in exchange for their original investment). Typically, this sum is three to five times the initial investment. Companies like Clearbanc charge a flat fee for their capital. Uncapped is also another fantastic example of a revenue-based financing company.

Essentially, organizations offering revenue-based financing use data-driven methods to provide ecommerce companies with funding. Capital is typically spent on online marketing and inventory. The best thing about this kind of arrangement for the entrepreneur is that there aren’t any credit checks, personal guarantees, warrants, or covenants involved.

Why Should You Leverage Investors to Build my Ecommerce Business?

Whether you're leveraging angel investors, an equity investor, or the help of a venture capital firm, there's one significant advantage.

These kinds of investments are (usually) nowhere near as risky as taking out a bank loan. Unlike a loan, (depending on the contract you have with your investor(s)), invested capital doesn't typically have to be paid back if your business flops.

Plus, most experienced investors understand that they're playing the long game. So, there isn't quite as much pressure to make quick decisions and turn high profits immediately.

Why Shouldn't You Leverage Investors to Build an Ecommerce Business?

If you don't like the idea of losing some (or even complete) control of your business, then seeking the support of investors might not be the best option for you. Often investors become part-owners of your company, so depending on their share, there's a good chance they'll have a say about how you run your business. On top of that, should you ever sell your business, they'll also receive a portion of the profits.

How to Best Raise Capital to Fund an Ecommerce Brand

For this section of the blog post, we're mainly focusing on angel, venture capital, and equity investors.

When it comes to raising capital to fund an ecommerce brand, there are specific times in the business cycle when you're more likely to secure funding.

Yes, your best bet is to seek investment when you're actually ready to grow your business. But, securing financing, especially from an angel investor, can take roughly six months to a year.

So, it's advisable to start contacting and pitching investors roughly 12 months before you actually need the funds to boost your business to its next phase.

Not only will this increase the likelihood of securing funding for when you actually need it, but for every failed pitch (yes, sadly, there will be failures), you'll benefit from those all-important pointers.

The more investors you talk with, the more apparent it becomes what investors want to see from your company and your business plan before they're happy to invest.

With this info to hand, you're then in a better position to adapt your business (and your pitch), to meet the needs of investors, when you actually need the funding.

How do you strike up a Relationship with a Potential Investor?

Typically, you'll kickstart your relationship with an investor by presenting a business plan. Do your utmost to wow them from the get-go, so they'll only be telephone a call away when you need capital.

As we've just said, if you're preemptively pitching investors before your business is fully investor-ready, the investor will probably point you in the right direction.

You can then go away and mull over this information and make the necessary changes to increase the chance of them investing in your business in the future.

What Can You do to Prepare your Business for Investment?

The best thing to do is to write a full business plan. The most important thing for lenders is what they'll get from the arrangement. As we've already hinted at, you'll want to highlight your expected financial projections. This serves as much-needed bait for enticing investors into funding your business.

We talked about business plans a bit earlier. However, they're essential to securing funding, so we're delving a bit deeper into creating a killer business plan (of course, this advice also applies if you're considering a bank loan)...

Here are a few tips:

- Keep your business plan as concise and to the point as possible. Just focus on what the reader needs to know.

- Thoroughly proofread your business plan - you can use Grammarly to help you weed out and fix any typos.

- Use charts to help illustrate your points, visuals are often helpful aids.

- Include any extra info in an appendix, for instance:

- Financial forecasts

- Market research and data to back up your proposal

- The resumes and credentials for all your key team members.

- Any product/service literature that explains what you're bringing to the market.

Don't be tempted to be overly optimistic about where your profit forecasts are concerned. Yes, this might up your chances of securing the desired finances. Still, in the long run, you're more likely to suffer from a cash flow crisis and damage your management credibility. Put simply, it's not worth it - stick to the truth.

Also, ensure your business plan looks as professional as possible. Show the lenders you're taking their investment seriously! So, put a cover on it, include a contents page complete with page numbering, and kickstart your proposal with an executive summary.

For those unsure what an executive summary is, it's just a condensed synopsis of the key points covered in your business. The reader's digest version if you will.

On top of that, you'll also want to highlight the following details:

- How your business runs, including a breakdown of your organizational structure and all the stakeholders' roles and responsibilities.

- Your brand identity - who you are, your brand story, your goals, mission, aims, etc.

- A detailed report of your target market (this should include any weaknesses in your competitors’ products/operations you'll capitalize on).

Other Tips for Securing Investment

As you go about creating your pitch, familiarize yourself with your audience. You want to know your potential lenders inside out and back to front to tailor your pitch accordingly.

Yes, specific metrics (like your current profits and profit forecasts) lay the framework for any pitch. Still, you'll need to tailor your core messaging to appeal to each investor's needs.

The key takeaway: Do your homework and modify your presentation accordingly.

Last but not least, remember business financing is a process. It's likely you'll have to divide your financing objectives into two to three rounds. Securing funds for your business when it's brand-new, (and all risk), and has very little revenue behind it, is more of a challenge.

So, when you first start out, you're unlikely to obtain all the money you need to launch and scale your business. But, once you have a working prototype and a loyal customer base, you'll take away some of the risks, and as such, you'll probably secure more funds. Prepare for this in advance by dividing your business's growth into specific sections that you raise funds for accordingly.

How Much Can Ecommerce Brands Raise?

There are tons of examples of ecommerce brands furthering their business by raising capital. Take Womenswear retailer, Hush, as an example. Hush sells women’s clothing, shoes, and lifestyle items. Currently, it's retailing its products via its website, its partnership with John Lewis.

But, recently, they've secured investment from a private equity firm, True. Hush, now worth over 50 million dollars, plans to utilize these funds to expand into new sales channels and markets.

True acquired a controlling interest in Hush, (roughly a 50% stake). This is what the owners of Hush had to say about the investment:

“We never thought [Hush] would get to a fraction of the size it is,” “We could have carried on [without outside investment], but we felt...real value in bringing in a partner with a similar vision to us, but different skills, to help us grow.”

Interestingly, this is what True had to say about investing in Hush:

“We think highly profitable, predominantly direct-to-consumer brands such as Hush...will emerge in [good] shape from this current crisis – and completing the transaction now demonstrates that we’re very much open for business and excited about the opportunity ahead of us.”

What About Crowdfunding?

If you're considering crowdfunding avenue, below are a few brands that smashed their targets. Hopefully, these examples will fuel you with inspiration:

Pebble – also known as “The Kickstarter Watch”

Pebble successfully raised $10.3m, when their target was just $100k!

This is what they had to say about the process:

“We had a pretty firm idea of what Pebble would look like. We just didn’t have a bunch of cash to start actually building the product. So, we thought of some other ways to get funding, and one of them was Kickstarter."

Bo & Yana

These are interactive toy robots that help teach kids how to code. Product owners, Play-i, managed to raise a whopping $1.4 million when their initial aim was just $250k.

Play-i successfully attracted investors from dozens of countries around the globe, securing 11,000 pre-orders! Interestingly, this company utilized crowdfunding to test the market and get a feel for consumer demand, having already secured $1m from Google Ventures.

How did Play-i manage to entice so many crowdfunding investors?

In short, they provided various benefits to their first buyers:

“We needed to build social proof right off the bat, so we created special perks for the first few buyers. Our first 1,000 backers got limited edition, exclusive outfits for their robots as an incentive to back early. We emailed our existing audience and friends several hours before our campaign went live [to] be among the first to back the project. This gave us the momentum we needed to get off to a good start.”

The team at Play-i also responded personally to all their audience interaction - every email, comment on Facebook, query on Twitter, etc. It stands to reason investors and customers feel more confident in your brand when they have a personal connection with you and your business. By taking the time to write customized responses to each and every person who wrote them, they ensured people got excited about their product!

OpenaCase

OpenaCase is described as the 'world’s most functional iPhone case is a bottle opener.'

The ecommerce brand managed to raise an impressive $283k, massively exceeding their $150k target.

This is what the founders had to say about the crowdfunding process:

“We didn’t have the capital, so we turned to crowdfunding... When we put the idea on Kickstarter, we realized... lots of people loved the idea and were willing to put money towards it to make it happen. [There's] Nothing better than having your idea validated by people voting with their wallets.”

They attracted attention to their crowdfunding campaign by creating a Facebook page, and contacting online publications like Tech Crunch and Gizmodo, that's as well as their local paper. They spent lots of time cultivating as much possible PR to gain the traction they needed to raise those all-important funds.

Are You Ready to Secure the Funds You Need to Launch or Scale Your Ecommerce Business?

We hope that having read this article, you now have a better idea about raising the funds you need to take your ecommerce brand to the next level.

As we said from the get-go of this article, Gorgias wants to help ambitious e-commerce brands scale up, so we created the Vested Interest event. If you're interested in securing finances from high-quality investors, then what are you waiting for? Apply today to get the ball rolling! If you have any questions about the show, please feel free to reach out, and we'll furnish you with all the info you need. Speak soon!